IFMR Graduate School of Business MBA Admissions 2026

MBA Admissions Open 2026 | UGC Approved Programs | Near 100% Placement Record | Up to 100% Scholarships | Highest CTC 21.32 LPA

Finance is amongst the most high-paying and rewarding disciplines in the world. There are a lot of promising courses at certification, diploma, undergraduate, postgraduate, and doctoral levels. A degree or a certification in finance allows candidates to explore several domains, due to the widespread applicability of Finance in every industry. However, choosing the most appropriate course can be an enormous challenge. CFA (Chartered Financial Analyst) and MBA (Master of Business Administration) are the two most rewarding courses in Finance.

This Story also Contains

CFA is a popular certification in finance that is globally recognised and considered a golden career in finance. The CFA course is divided into three levels: Level 1, Level 2, and Level 3. Similarly, an MBA or Master of Business Administration is another popular course offered in the field of management. Candidates can choose their preferred specialisation according to their interests.

While both the CFA and MBA offer a very promising career in finance, there are many differences. Candidates can choose any of the courses to have a great future in the finance domain. In this article, we will discuss the similarities, differences, scope, career opportunities, eligibility criteria, and admission guidelines of both of these courses.

MBA Admissions Open 2026 | UGC Approved Programs | Near 100% Placement Record | Up to 100% Scholarships | Highest CTC 21.32 LPA

Comprehensive 4-year BBA with a 3-year exit option under NEP 2020. Core coverage of Finance, Marketing, Entrepreneurship, Analytics & HR

CFA or Chartered Financial Analyst is a popular charter that is generally pursued by candidates interested in working in the BFSI segment. CFA charter is an official designation offered by the CFA Institute to those who have cleared all the levels and have met all the course requirements. CFA is one of the most respected designations offered in the field of finance and allows candidates to choose from a lot of high-paying careers.

To be eligible for the CFA charter, candidates must have fulfilled some enrollment requirements. Students can check these requirements on the official website of the CFA Institute, which is www.cfainstitute.org. However, for the student’s reference, we have mentioned the eligibility details of CFA below.

Recognized as Category-1 Deemed to be University by UGC | 41,000 + Alumni Imprints Globally | Students from over 20+ countries

Highest CTC International 23.31 LPA | Highest CTC Domestic 12.5 LPA | Average CTC 7.5 LPA | Avail Merit Based Scholarships

Alternatively, candidates should also meet the requirements below.

A minimum of 4000 hours of professional work experience, or a combination of work experience and education that is accrued over 36 months (or a minimum of three years duration).

| Eligibility Parameters | Details |

|---|---|

Passport required | International travel passport |

Qualification requirements | Bachelor’s degree or equivalent |

CFA Level-1 Qualification Requirements | To apply for a CFA course, candidates should complete their bachelor’s degree from a recognised institute in India. |

Work Experience/Educational Academic Duration Requirements | 4000 hours of work experience or a combination of work experience and education that is accrued over 36 months (3 academic years) |

CFA is often considered a gold standard in finance and prepares graduates for a range of job roles. The course curriculum of a CFA institute is very comprehensive, however, it is very exhaustive and requires in-depth knowledge and practical knowledge. Listed below are some of the benefits of a CFA charter and how it helps candidates to have successful careers in finance.

Candidates can also check this article- CFA (Chartered Financial Analyst) - The Gold Standard in Finance, to learn more about how CFA is one of the highly desired courses for a successful career in the Finance industry.

MBA, popularly known as Master of Business Administration, is a well-known postgraduate degree programme in the field of business management. However, an MBA is a broad discipline consisting of a wide range of specialisations, popular ones being Finance, Marketing, and Human Resource Management. Individual colleges may have their own enrollment requirements for the course.

Only eligible students will be allowed to advance to the application process. Generally, for an MBA degree, the eligibility varies depending on the provider, the type of institute, and depending on the specialisation. Students can check the eligibility or qualification details on the official website of the provider or the programme brochure. However, some of the basic admission requirements for an MBA are provided below.

| Eligibility Parameters | Details |

|---|---|

Educational Qualification | Bachelor’s degree from a recognised institute in India |

Marks required | 50 per cent or more (for the general category), 5-10 per cent relaxation for candidates belonging to the reserved categories |

Entrance exams | CAT, MAT, CMAT, XAT, and NMAT |

Admission procedure | Entrance Exam+Group Discussion+Personal Interview |

Work Experience | Compulsory for Executive MBA, optional for other MBA courses |

Compared to the CFA (Chartered Financial Analyst), an MBA provides broader business knowledge to the candidates. While an MBA in Finance provides a promising career path in the field of Financial Services, students can also choose a range of specialisations depending on their interests and future goals.

MBA Finance graduates can explore areas such as investment banking, financial analysis, taxation, and the BFSI segment. Graduates can work in both private and public sectors or can pursue entrepreneurship and set up their own financial firms.

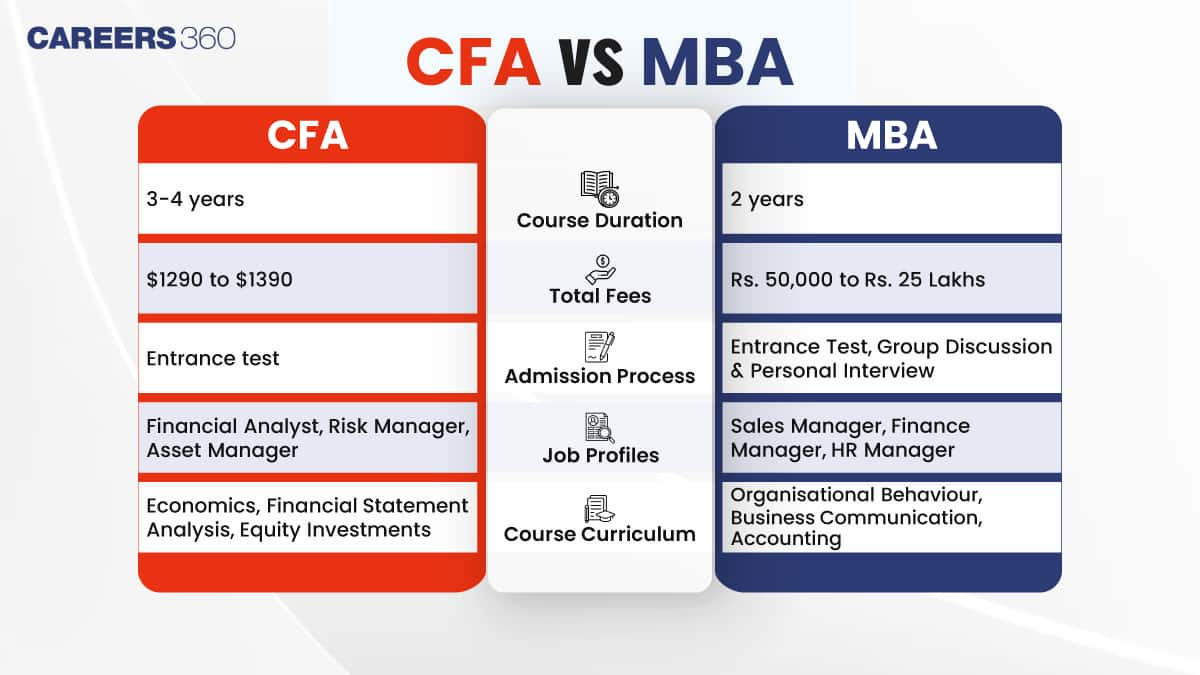

The table mentioned below compares both MBA (Master of Business Administration) and CFA (Chartered Financial Analyst). For further information, candidates can check the official website of the CFA Institute or their desired MBA institute.

| Particulars | CFA | MBA |

|---|---|---|

Course Duration | 3-4 years | 2 years |

Fees for the entire duration | USD 1290 to USD 1390 (fees for early registration will be USD 990 for levels 1 and 2, and USD 1090 for Level 3) | Rs. 50,000 to Rs. 25 Lakhs |

Admission Process | Entrance test | Entrance Test, Group Discussion and Personal Interview |

Job Profiles | Financial Analyst, Risk Manager, Asset Manager | Sales Manager, Finance Manager, HR Manager, and Marketing Manager |

Course Curriculum | Economics, Financial Statement Analysis, Equity Investments, Derivatives (Regularly updated to meet the industry requirements) | Organisational Behaviour, Business Communication, Quantitative Methods, Accounting, Business Research Methods, and Legal Aspects of Business |

To conclude, both MBA and CFA are excellent courses for someone interested in working in the field of Finance. Both these courses offer excellent knowledge of finance and prepare the graduates for a variety of career options. Students can also apply for higher-level degrees after graduation. Some of which are Ph.D, or M.Phil in Finance or similar disciplines. CFA and MBA are both indeed valuable courses, each offering good knowledge and a successful career in Finance.

On Question asked by student community

Hello

If you are looking to take admission in the MBA programme with a CAT score of 73, check out the list of MBA Colleges accepting 70-80 percentile .

All the best!

Hi Apurva, TCS is one of the reputed multinational of India providing numerous job opportunities to students. The TCS Job available after an online MBA include business analyst, hr executive, project manager, IT consultant and many more. Please check top careers at TCS with online MBA to know more job

Hello, you can get the best colleges for online MBA here. Many top Bschools today also provide online MBA programmes including IIM Ahmedabad, IIM Bangalore, and XLRI Jamshedpur.

There are several government and private colleges in India offering UGC-recognised Online MBA. Some of which are as follows:

Here are some useful article links for more read :

UGC Approved Online MBA Colleges in India 2026: Complete List, Fees,

Ranked among top 10 B-Schools in India by multiple publications | Top Recruiters-Google, MicKinsey, Amazon, BCG & many more.

Among top 100 Universities Globally in the Times Higher Education (THE) Interdisciplinary Science Rankings 2026

Apply for UG & PG programs from Victoria University, Delhi NCR Campus

Application Deadline: 10th March | Globally Recognized by AACSB (US) & AMBA (UK) | 17.8 LPA Avg. CTC for PGPM 2025

Industry Internship Training

NAAC A++ Accredited | Ranked #12 by NIRF